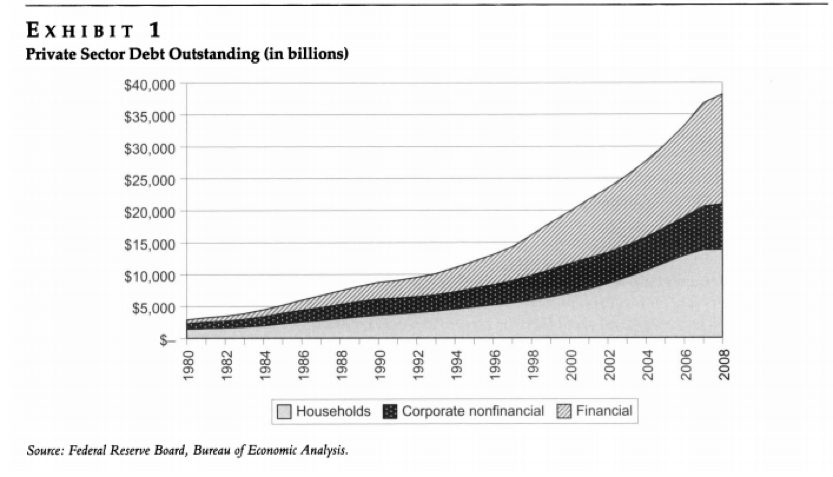

Since the real estate crash in 2007 the single-family housing market has been under close surveillance by investors, banks, and homeowners alike. Economists and analysts primarily credit the loose lending policies and low-interest rates as the cause of the real estate bubble that superseded the crash. Debt rates skyrocket during the housing price bubble period and American homeowners, believing that prices would continue soaring, continued to over leverage their properties. Figure 1 depicts private debt in America at the time of the bubble.

Figure 1

There was a nearly exponential increase in private debt directly preceding the crash.

Because of the bubble and crash, millions of home owners could not make their payments. Banks were forced to foreclose on properties and sell them at auctions for a fraction of their previous price. Following the real estate crisis, the federal government and banking industry implemented stricter regulations and credit standards to prevent a similar relapse, many prior and prospective homeowners converted to renting their primary residences, and real estate investors began seizing opportunities to buy real estate owned (REO) properties from banks for pennies on the dollar.

As American incomes and real estate property values began to recover from the recession, many Americans remained in multi-family housing complexes. Real estate investment trusts (REITs) and real estate private equity (PE) funds capitalized on this period of increasing demand for rental housing and appreciating real estate by investing in multifamily housing. Many REITs and real estate PE funds realized over 30% total returns. In the most recent years, multifamily returns have been settling down, and some investors are turning to single-family real estate markets as a complementary investment vehicle.

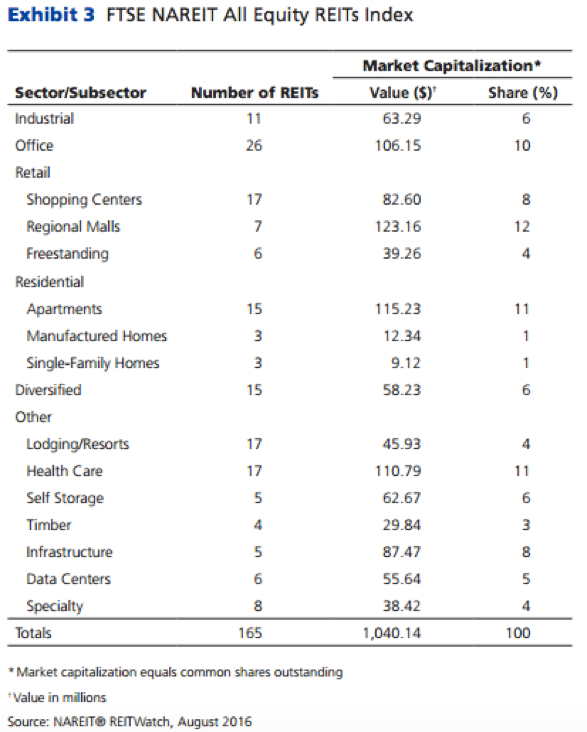

At the end of 2016, the Financial Times and London Stock Exchange/National Association of Real Estate Investment Trusts (FTSE/NAREIT), an index listing all publicly traded REITs, closed with a total return of only 9.3%. Single-family REITs significantly outperformed average REIT and closed at a total return of 26.4%. Commercial REITs have been around for over 60 years; however, it wasn’t until recently in 2013 that Silver Bay Realty Trust, the first single-family REIT, went public. Since 2013 a handful of other publicly traded single-family trusts have initiated public offering (IPOs), the most recent being Blackstone’s IPO of Invitation homes. Has the single-family housing market been overlooked? There are three major factors to consider when answering this question: (1) Future expectations in homeownership rates, (2) single-family housing market risks, and (3) expected returns.

Home Ownership

Current Homeownership Rates

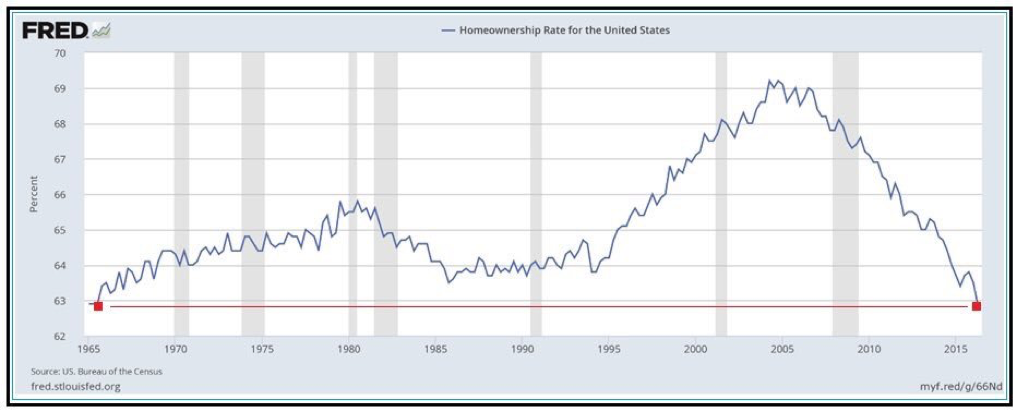

The commonly accepted single-family REIT strategy of buying homes at discounted prices, renovating them, and renting them out makes homeownership rates an area of significant interest to real estate investors. Professor James R. DeLisle, Ph.D. in real estate and urban land economics, director of Academic Real Estate Programs at Henry W. Bloch School of Management, notes that both home prices and home sales are trending upwards; yet, homeownership rates are the lowest they have been “in over 50 years” (DeLisle, 2016). Figure 2 illustrates homeownership rates over time from 1965 to mid-2015.

Figure 2

The last time US home ownership rates were this low was 1965.

Future Expectations in Homeownership

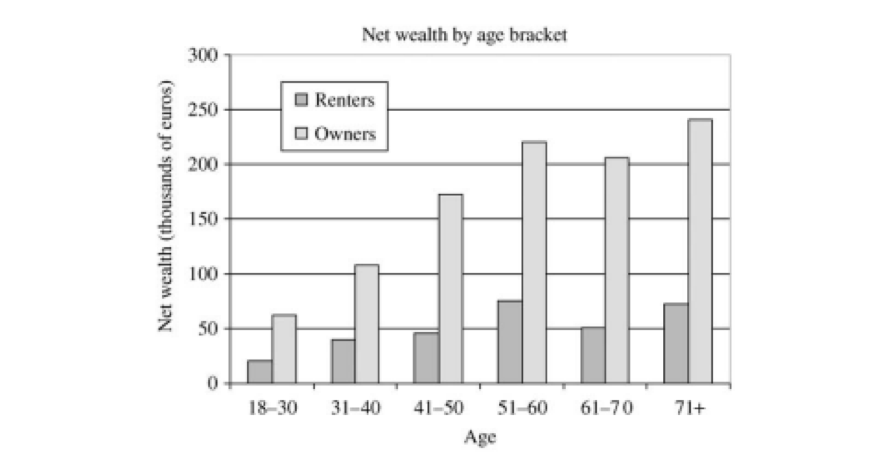

Many single-family REITs bet on homeownership rates to remain low and hope to continue capitalizing on a strong rental market. Wall Street Journalist Ryan Dezember is more skeptical; though he agrees that rising interest rates will make it harder for renters to buy homes in the future, he suggests that “Single-family rental companies must convince investors that the single-family rental model will remain viable if home ownership levels rebound” (Dezember, 2015). This is a valid point to consider. With home ownership rates this low, have they anywhere else to go but up? Flavin and Yamashita were referenced in both the Journal of Real Estate Finance and Economics and The American Economic Review for a study they performed that suggests a life-cycle relationship between age and homeownership. Figure 2 displays a representation of their findings (Flavin and Yamashita, 2002).

Figure 3

As generational cohorts mature and acquire wealth home ownership rates increase.

The Millennial Impact

Statistics extracted by Zillow suggest that the average age of the American first time home buyer is 33 years old. Millennials, ranging from age 18 to 34, recently overtook the baby boomers as the largest generational cohorts and are just beginning to reach home owner ages. According to Flavin and Yamashita’s logic, as millennials mature in both their ages and their careers they are likely to accumulate wealth and have a tremendous impact on home ownership rates. Though the possibility of an upward swing in home ownership rates is a valid concern, it is not necessarily a threat to the single-family investment market. Some single-family investment platforms, such as Equistream headquartered in Tampa Florida, buy foreclosed homes at a discount then sell them owner financing to the home buyer rather than renovating and renting them out. An upward swing in home ownership rates may provide an opportunity for firms to utilize the seller financing model rather than the rental model. Dale Domian, Rob Wolf, and Hsiao-Fen Young, faculty from York University, Toronto, Canada and the Department Finance, University of Wisconsin at La Crosse point out that, “Assessing the impact of homeownership on a scenario analysis of portfolio performance is useful, however it is also important to price asset risk and return with some theoretically based models” (Domian, Wolf, and Young, 2015). In addition to analyzing home ownership rates, analyzing the risks and returns of the housing market will better answer the question whether the single-family market is being overlooked or not.

Risk

The residential real estate market is well known for providing high returns at relatively low risk; however, some point to the possibility of another economic downturn and challenges in the management of scattered single family properties as potential risks.

Risk of Economic Downturn

Though the residential real estate market has performed very well in recent years, Wall Street Journalist AnnaMaria Andriotis cautions investors to remember the 2007 financial crisis and points out that in the event of weakened economy, renters would struggle to make payments resulting in losses to investors (Andriotis, 2014). A weakened economy is a valid concern, but it is a concern shared by all investments and not market specific to residential real estate. Domain, Wolf, and Yang point out the exceptionally low-risk profile of residential real estate, “prior studies find residential real estate has low risk as measured by standard deviation, beta, and correlation with the equity markets” when investigating the risk-return relationship further, they find the excess return of residential real estate and the Sharpe ratio is “disproportionately high”(Domian, Wolf, and Young 2015). Basic economic principles suggest that necessity goods such as food and shelter have lower elasticity in demand and are therefore less subject to variation otherwise known as market risk. Because housing is a necessity that everyone needs, these basic principles are consistent with Domain, Wolf, and Yang’s statement that residential real estate has a relatively lower deviation and risk when compared to other equity investments.

Property Management

Multifamily investment platforms consolidate multiple housing units into a single property and manage them as one aggregated investment; skeptics of the single-family industry question whether the distance between properties will prevent investors from managing properties with a similar level of competitive efficiency. Dezember stated, “Single-family rental companies also face questions about their ability to maintain tens of thousands of scattered properties. The chores include cutting lawns, fixing sinks, insurance and keeping track of rental rates and payments” (Dezember, 2015). This is another example of a challenge that is avoided by investment firms who sell their properties, as is, owner financing. As for rental platforms, the largest real estate private equity firm in the US, Blackstone, demonstrated confidence in their ability to manage scattered properties when they engaged in an IPO of Invitation Homes.

Return

Multifamily returns are settling down back towards the market averages; meanwhile, single-family returns have surpassed apartments and are projected to continue outperforming them in the short-term sub sequential years. In the long run, real estate investors will likely notice the excess profitability and saturate the single-family market which will diminish REO supply until returns approach the market norms.

Returns in the Short Run

In the short run, single-family returns are likely to outperform the multifamily real estate sector. About 3 years ago J.P. Morgan’s Executive Director over REITs and Real Estate services, Anthony Paolone, stated in a report that, “What do we need for the single-family rental REIT stocks to work? Perhaps the rest of the REIT space to cool off a bit” (Paolone, 2014). At the time multifamily investments were out performing single family total returns by about 10%. Since his statement in 2014, apartment REITs have done just that, cooled down; meanwhile, the single-family space is heating up. Just this year in a similar report Paolone, speaking of the coming years, remarked that “We thus see a few years of runway for outsized NOI growth that is germane to INVH and its peers and double what we see coming from the apartment REIT space” (Paolone, 2017). For the time being, there is an opportunity to get in the single-family space and capitalize on a few years of runaway returns in a similar way that those who invested in multifamily following the crash capitalized. Figure 4 represents a graph from Paolone’s study, which shows what percent of REITs are currently accounted for by single-family investments.

Figure 4

Single-family REITs only account for 1% of total REITs

Even though the single-family market is likely to outperform multifamily in the proximate years, it appears that most investors are overlooking this opportunity. In the long run, savvy investors will likely catch on to this opportunity and enter the market making it more competitive just as they did in the multifamily market.

Returns in the Long Run

In the long run, investors and investment platforms will continue to enter the single-family rental space until the market reaches equilibrium and total returns rebound toward market averages. Wall Street Journal author Telis Demos cited several reputable sources such as Stephanie Ruiz, a managing director of Credit Suisse; Warren Buffett, chairman of Berkshire Hathaway; and Gary Beasley, founder of a firm that owns and manages over 3,500 homes, all pointing towards the belief that there is an excess of profitability in the single-family home space and that many institutional investors are likely to follow Silver Bay Realty Trust’s lead in taking part in the market (Demos, 2013). What will happen when big, institutional investors continue to enter the single-family rental market, a space that has traditionally been designated mom and pop investors? The increase in demand will continue to push home prices upwards and begin to exhaust the supply of REO properties. Paolone noted that increase in home prices and a decrease in bank foreclosures is making it more and more difficult for investors to find opportunities at discounted prices (Paolone 2013). With institutional investors such as Blackstone and Colony Starwood buying foreclosure on homes by thousands and the number of foreclosures decreasing, the likelihood of shortage in supply is probably the greatest threat to the sustainability of exceptional returns.

Conclusion

The single-family housing market will outperform multi family investments in terms of total return for the subsequent years. Investment platforms that Institute flexibility of exit strategy by renovating and renting their properties when rentable units are in demand and seller financing their properties when ownership is in demand will likely benefit from the maturing millennial generation. Overall risk in the real-estate industry is relatively low, and risk of an economic recession can be managed by buying REO properties at discounted rates. In the long run, competitors will continue to enter the single-family space, REO supply will diminish, and single-family exceptional returns will rebound back towards market averages. For the meantime, the single-family housing market is certainly an overlooked opportunity but savvy investors will likely catch on in the same way they caught on to multifamily in the past.

ShareShare Is the Single-family Housing Market an Overlooked Opportunity?

LikedUnlikeIs the Single-family Housing Market an Overlooked Opportunity? CommentShareShare Is the Single-family Housing Market an Overlooked Opportunity?