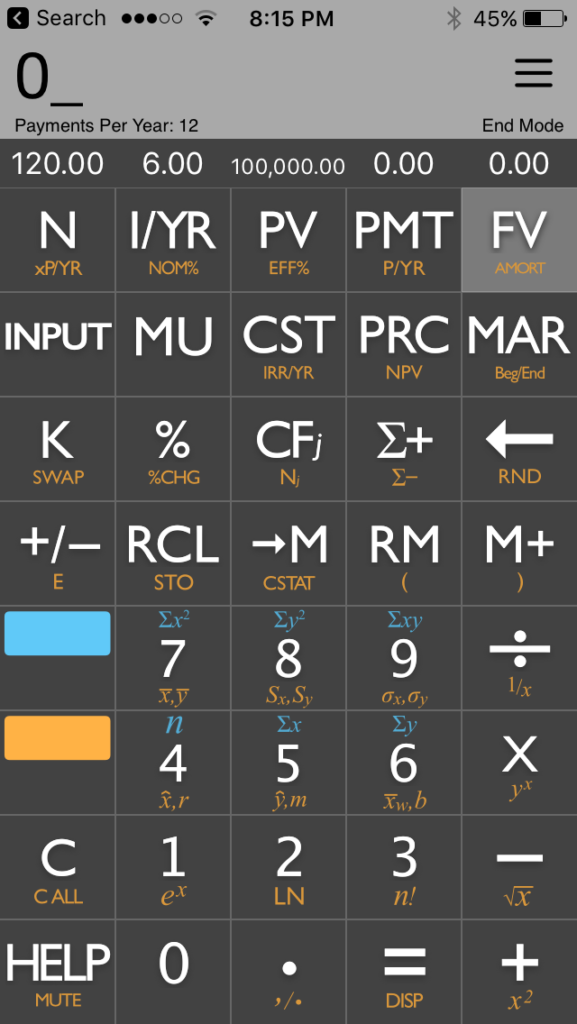

You’ll need a 10bii calculator. You can get one in the apple or android app store.

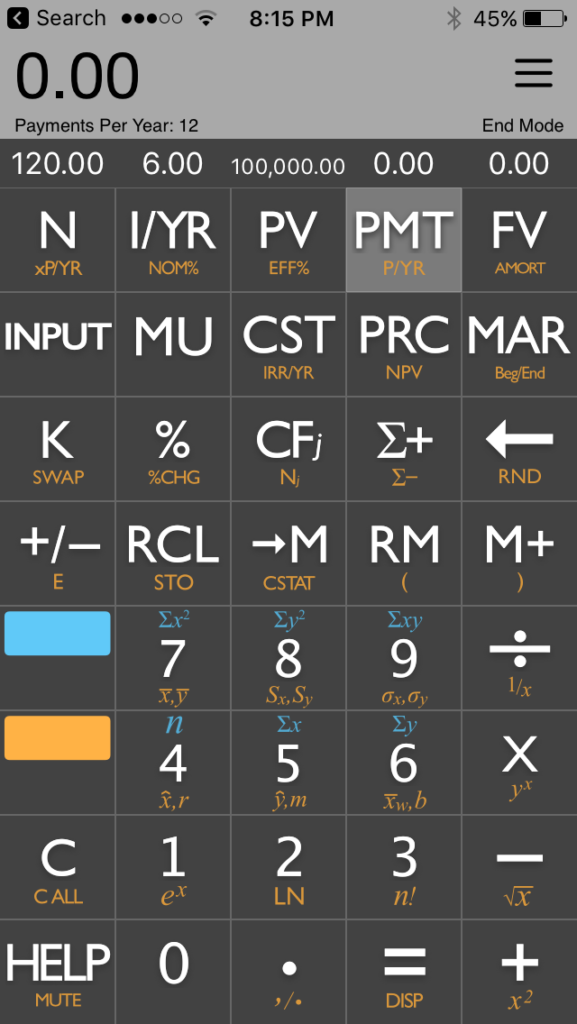

Payments per year should be defaulted to 12. If not, you will need to change that in settings.

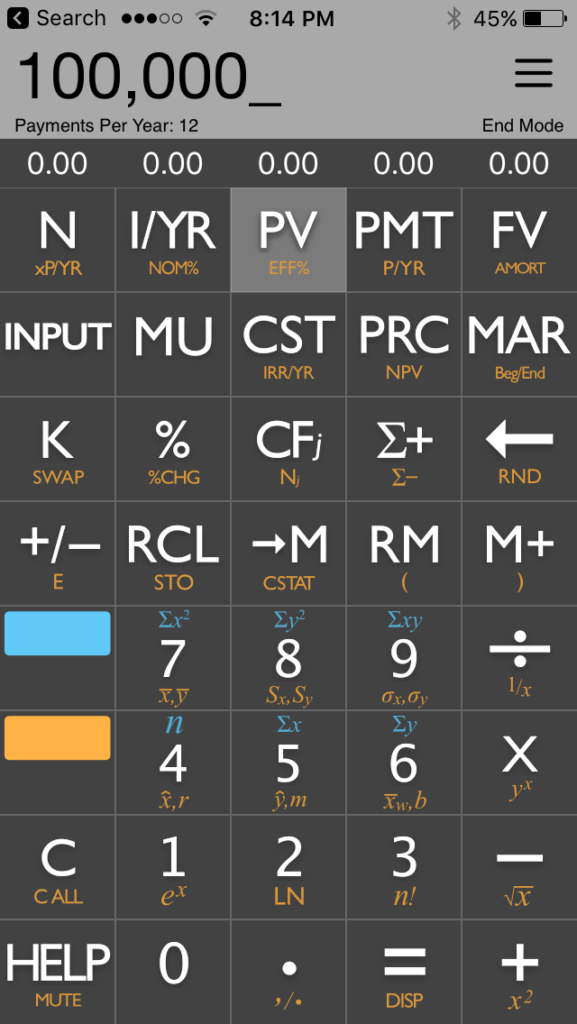

Type in the value of the unpaid principle value (we will use $100,000) and hit “PV” to set 100,000 as the present value of the loan.

Type in your interest rate (we will use 6%) and hit “I/YR” to set 6% as your interest rate.

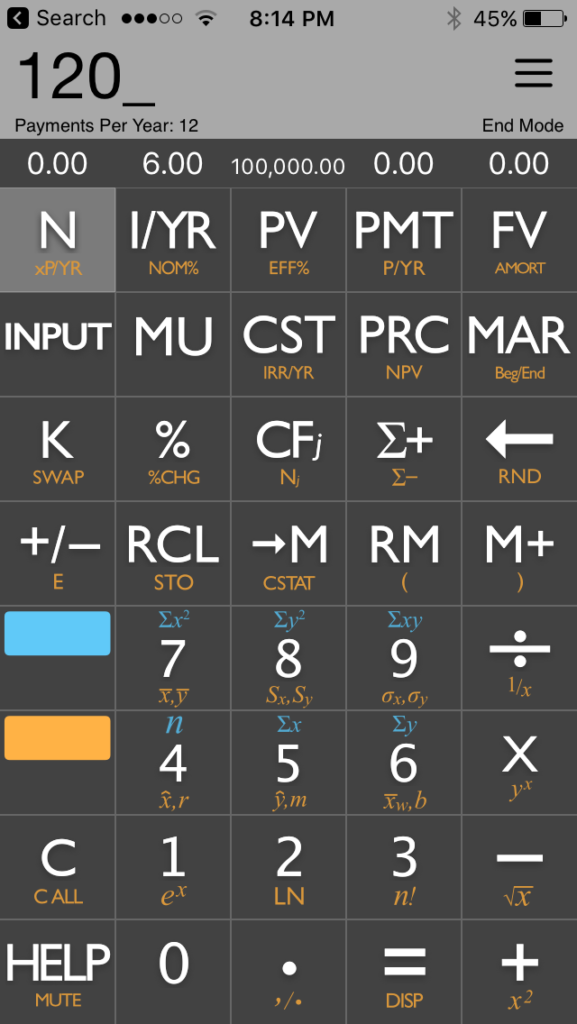

Type in the number of payments remaining on the loan (for this example we will use 120 for 10 years) and click “N” to set 10 as the number of years remaining on the loan.

Type in the future value of the loan (In this case and usually that will be 0) and click “FV” to set 0 as the future value at the end of 10 years.

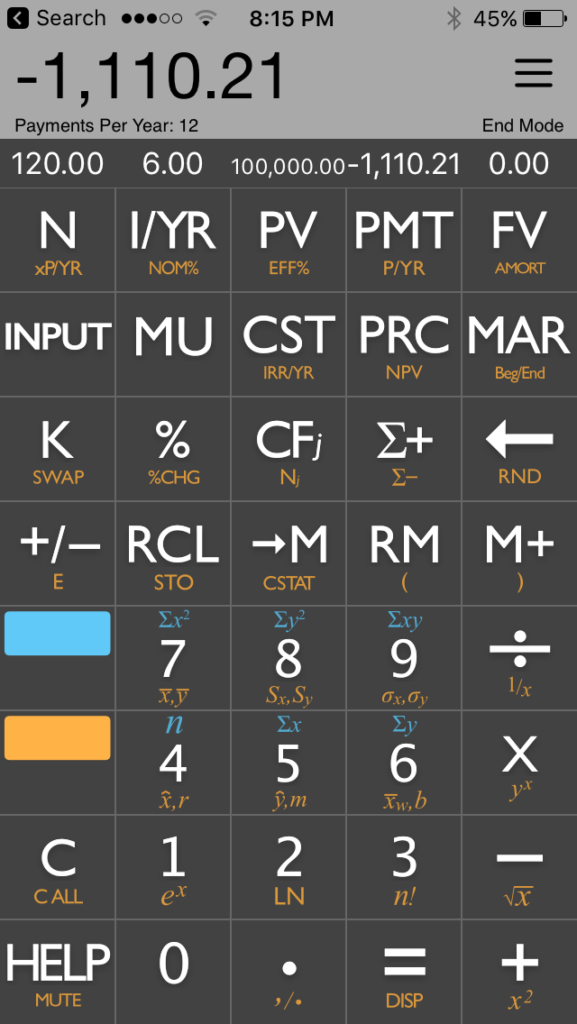

Click “PMT” to automatically calculate the monthly payment for the loan. In this example, we got -1,110.21 a payment of $1,110.21 per year.

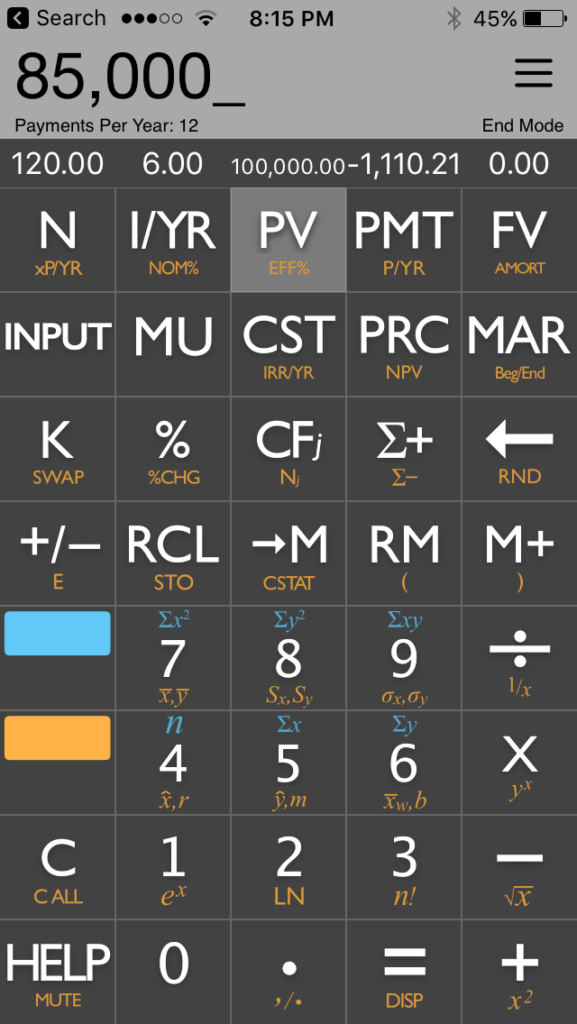

Type in the purchase price of the note (In this case we will be buying the note for 85% of $85,000) and click on “PV” to set your purchase price as $85,000.

Click “I/YR” and the calculator will automatically calculate your yield or ROI of 9.72 or 9.72%